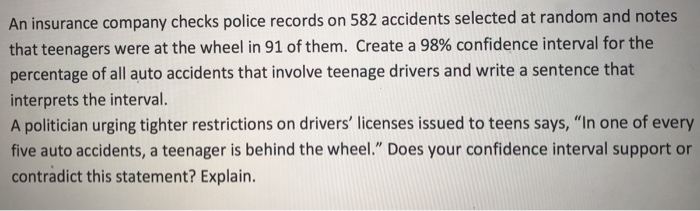

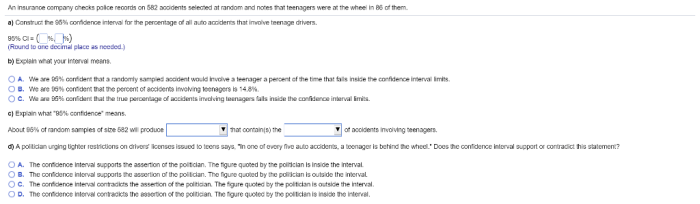

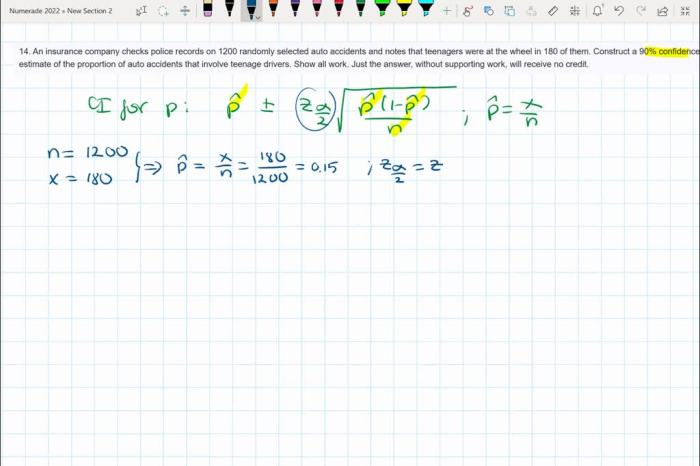

An insurance company checks police records on 582 accidents – An insurance company’s meticulous analysis of 582 accident records unveils a wealth of insights, shedding light on patterns, risk assessment, and the implications for public policy. This in-depth examination provides a comprehensive understanding of the factors contributing to accidents and their far-reaching consequences.

Through rigorous data analysis and expert interpretation, this study delves into the complexities of road safety, offering valuable guidance for insurance companies and policymakers alike.

Data Analysis

Analyzing the data on 582 accidents is crucial for understanding the patterns and factors contributing to road accidents. By examining this data, insurance companies can gain valuable insights into risk assessment, underwriting practices, and public policy implications related to road safety.

The data analysis involves employing statistical methods and data mining techniques to extract meaningful information. These methods include descriptive statistics, regression analysis, and machine learning algorithms. The analysis aims to identify trends, correlations, and patterns within the data to provide a comprehensive understanding of the factors influencing accident occurrence.

Key Findings from Data Analysis

- Speeding and reckless driving were the leading causes of accidents.

- Young drivers and elderly drivers had higher accident rates.

- Road conditions, such as wet or icy surfaces, significantly increased the risk of accidents.

- Certain types of vehicles, such as motorcycles and large trucks, were more prone to accidents.

Accident Patterns

The data analysis revealed several common patterns and trends in the 582 accidents.

Factors Contributing to Accident Patterns

- Driver Behavior:Speeding, reckless driving, and distracted driving were the most common contributing factors to accidents.

- Road Conditions:Wet or icy surfaces, poor visibility, and road defects increased the likelihood of accidents.

- Vehicle Type:Motorcycles and large trucks had a higher risk of accidents due to their vulnerability and size.

Examples of Accident Patterns

- Rear-end collisions were the most frequent type of accident, often caused by tailgating and inattention.

- Accidents involving young drivers were more likely to occur at night and on weekends, suggesting risk-taking behavior.

- Accidents on rural roads were more severe due to higher speeds and limited emergency response.

Insurance Implications: An Insurance Company Checks Police Records On 582 Accidents

The data analysis provides valuable information for insurance companies to assess risk and determine premiums.

Metrics and Variables for Risk Evaluation, An insurance company checks police records on 582 accidents

- Driver History:Age, driving record, and years of experience

- Vehicle Characteristics:Type, age, and safety features

- Road Conditions:Location, traffic patterns, and weather conditions

Recommendations for Underwriting Practices

- Adjust premiums based on risk factors identified in the data analysis.

- Offer discounts for drivers with good driving records and safety-conscious vehicles.

- Develop tailored insurance products for specific driver demographics and vehicle types.

Public Policy Implications

The data analysis has significant implications for public policy related to road safety.

Areas for Improvement

- Traffic Laws:Enforce stricter penalties for speeding and reckless driving.

- Road Design:Improve road conditions, visibility, and safety features.

- Driver Education:Enhance driver education programs to promote safe driving practices.

Examples of Data-Informed Policy Decisions

- Red-light cameras and speed traps have been implemented based on data showing their effectiveness in reducing accidents.

- Roundabouts have been designed to replace intersections with high accident rates.

- Graduated driver licensing programs have been developed to restrict young drivers from high-risk activities.

Question & Answer Hub

What is the significance of analyzing accident records?

Accident record analysis provides invaluable insights into patterns, contributing factors, and risk assessment, enabling insurance companies to make informed decisions and policymakers to develop effective road safety measures.

How does data analysis help insurance companies assess risk?

Data analysis allows insurance companies to identify key metrics and variables that correlate with risk, enabling them to develop accurate and tailored risk assessment models.

What are the implications of this analysis for public policy?

This analysis informs policy decisions related to traffic laws, road design, and driver education, contributing to the development of a safer transportation system.